The immediate financing arrangement (IFA) strategy can be a solution to help cover your future tax bills, or fund other estate planning objectives, without disrupting the cash flow needed to continue growing your business or investments.

As an affluent business owner or individual, one of your primary objectives is to build the value of your company or your personal wealth – and you’ve been successful at this. Your business is doing well and generating excess annual cash flow. This cash flow is being reinvested back into business operations, or investments, supporting its sustainability and future growth. While it’s good news when your business or investments are doing well and increasing in value, it also means a looming tax liability is growing. Any tax on the resulting capital gain must be paid when you or your spouse pass your business or investments over to the next generation. The IFA strategy can be a solution to help cover future tax bills, or fund other liquidity needs, without disrupting cash flow needed to continue growing your business or investment portfolio.

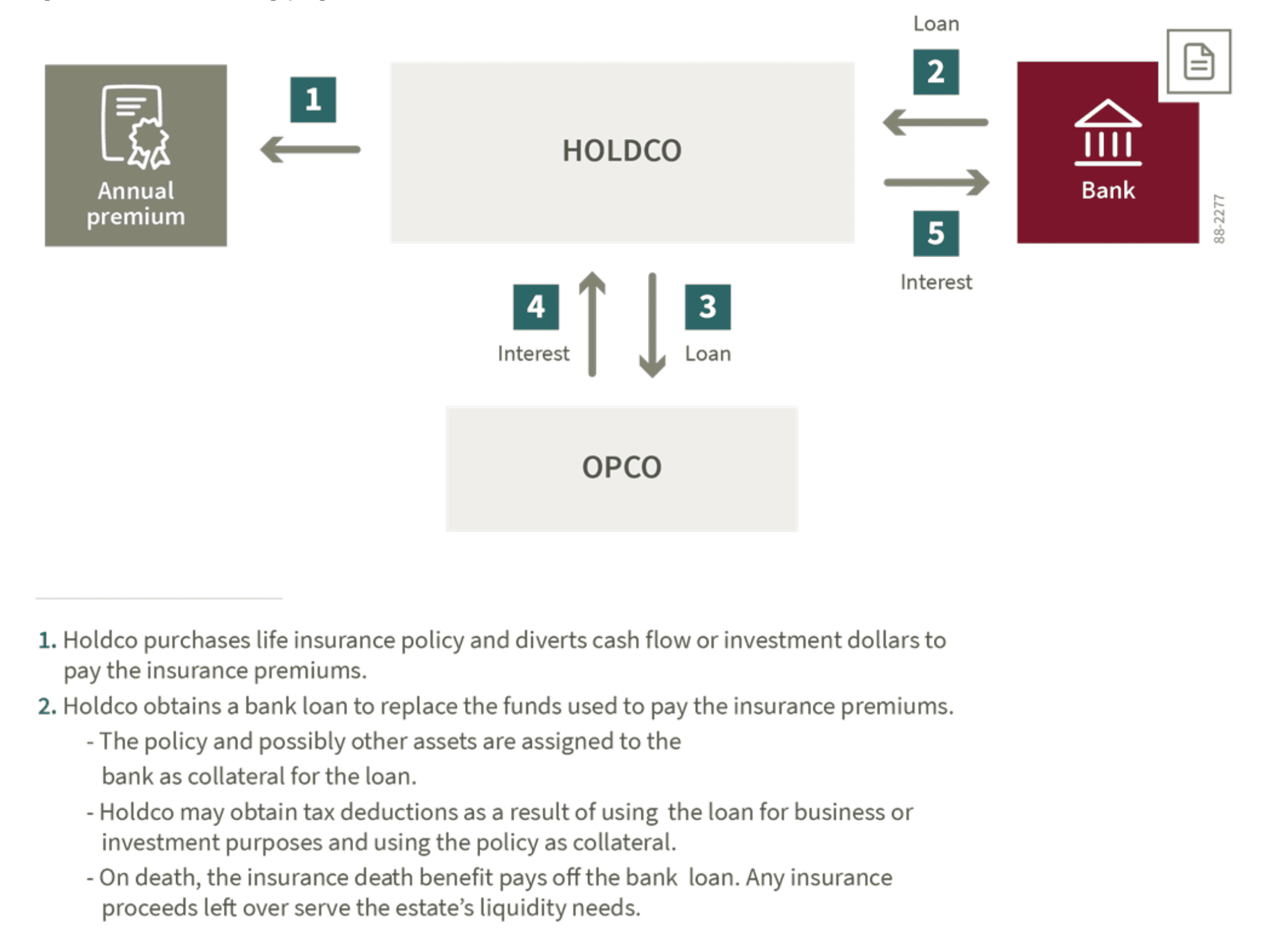

How the IFA works:

Your business (or you personally) purchases a life insurance policy on your life and diverts cash flow, or repositions investment dollars, annually into the policy for approximately ten years.

Your business applies for and obtains a bank loan to replace the funds used to pay the insurance premiums:

The policy is assigned to the bank as collateral for the loan.

Other assets may be temporarily assigned to the bank as collateral for the loan. Over time the cash value of the policy may become large enough that this additional collateral may no longer be required.

Your business pays the loan interest to the bank going forward.

Generally, the loan may be paid off at any time.

Your business may obtain two tax deductions as a result of using the loan for business or investments purposes by assigning the policy to the bank as collateral for the loan:

Interest deduction – Generally, interest is tax deductible if it’s paid (or payable) on a loan that’s used for business or investment purposes.

Collateral life insurance deduction – Generally, a policyowner may deduct the lesser of a policy’s net cost of pure insurance and the premium payable where the policy is assigned to a bank as collateral for a business or investment loan. The amount deductible must be considered to reasonably relate to the amount owing.

On your death, the insurance death benefit pays off the bank loan. Any insurance proceeds left over serve your estate’s liquidity needs.

The diagram on the following page illustrates how the IFA works.

Benefits of the IFA

As a strategy for funding permanent life insurance coverage, the main benefits of the IFA are:

Business and investment capital is largely intact. The funds used to pay the life insurance premiums are replaced by money borrowed from the bank. As a result, your business’ opportunity costs of obtaining permanent coverage on your life are minimized.

Costs of obtaining permanent life insurance coverage are drastically minimized in the short-term (first six to seven years) and potentially may be significantly minimized over the remaining years of your life. The net out-of- pocket costs of the life insurance are effectively the loan interest less the tax savings from the interest and collateral life insurance deductions.

Example – Chris and Meghan

Let’s look at how the IFA works for Chris and Meghan, who are successful business owners. They are married, each are 60-years-old, non-smokers with standard risk. They operate their business through a corporation (Opco) which is wholly owned by their holding company (Holdco). Their advisor and tax professional anticipate they’ll need approximately $5,500,000 of life insurance coverage at life expectancy. Opco and Holdco have enough cash flow and liquid assets to fund insurance costs; however, Opco is in the middle of a large project and they prefer to minimize other financial commitments until it’s completed. The IFA allows them to achieve this objective while obtaining permanet insurance coverage. They want to implement the IFA strategy with Holdco as the policyowner.

Participating whole life and the IFA

Chris and Meghan’s advisor recommends Holdco purchase a participating whole life insurance policy when using the IFA strategy. Financial institutions recognize the relative stability of participating life insurance and, depending on the lender, accept between 90 and 100 per cent of a participating policy’s cash value as collateral for a loan or line of credit. Participating life insurance policies also have the added advantage of entitling the policyowner to the collateral life insurance deduction in a year where the policy has a contractual premium even when the policy is on premium offset (where the policy dividends pay the premium) as long as inter alia that the interest on the loan or line of credit is deductible.iv This tax deduction may be significant in later years. This isn’t the case with universal life and other life insurance policies where the amount of the premium that must be paid is not stated in the contract. In such case, where there’s no out-of-pocket premium payment, the collateral life insurance deduction wouldn’t be available.

IFA’s impact on net cash flow

Let’s look at the IFA using a Canada Life Wealth pay to 100 participating life insurance policy with joint last-to-die coverage on the lives of Chris and Meghan. Holdco will be the owner, payor and beneficiary of the policy. The policy has a basic coverage of $3,586,286 and total annual premium of $250,000, of which $156,039 is additional deposit option. Holdco will pay out-of-pocket premiums for ten years, after which the policy will be on premium offset. The policy will have a paid-up addition dividend option and the policy values referred to below assume a dividend scale interest rate of 5.25 per cent.

The IFA loan will have an interest rate of five per cent. After ten years the total loan will be approximately $2,500,000. The loan to cash value margin ratio is 100 per cent. The peak amount of additional temporary collateral Holdco will need to provide to the bank is approximately $47,000 in year two and this amount reduces to nil at year five.vi Holdco will pay the interest costs on the loan. It will also lend the bank loan proceeds to Opco and charge interest. The interest will be treated as active business of Holdco and subject to tax at the general business rate of 27 per cent. We’ll assume the interest and collateral life insurance deductions may be used to offset this income.

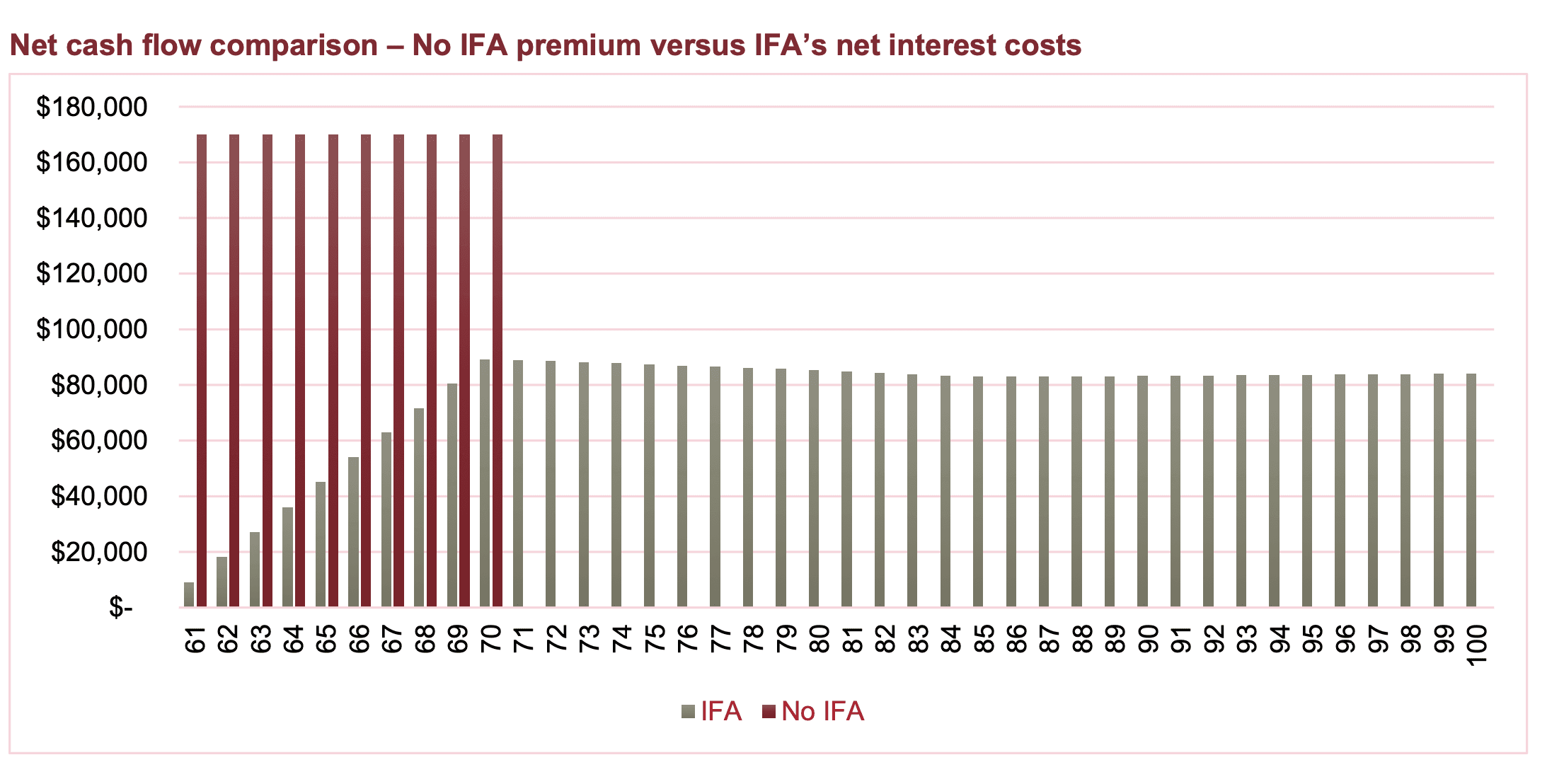

The IFA strategy minimizes the impact of insurance costs on your business’ cash flow

As seen in the chart below, a significant advantage of the IFA is its remarkably low impact on Holdco’s net cash flow in the first six to seven years and the overall lower impact in the later durations. Net cash flow is the annual interest payments less the annual tax savings from the interest and collateral life insurance deductions.

The chart illustrates the year-over-year net cash flow impact of the IFA compared to where Chris and Meghan chose not to use the IFA strategy. This means Holdco would purchase a policy without using leverage so that its death benefit is similar to the net death benefit produced from the IFA. In that scenario, we compare the IFA to the Wealth pay to 100 participating life insurance policy, JLTD, having $2,438,674 of basic coverage maximum and a total premium of $170,000, of which $106,107 is ADO, paid out-of-pocket for ten years. The death benefit at age 92 of $5,488,740 is approximately equal to the IFA’s net death benefit of $5,571,679 at the same age.

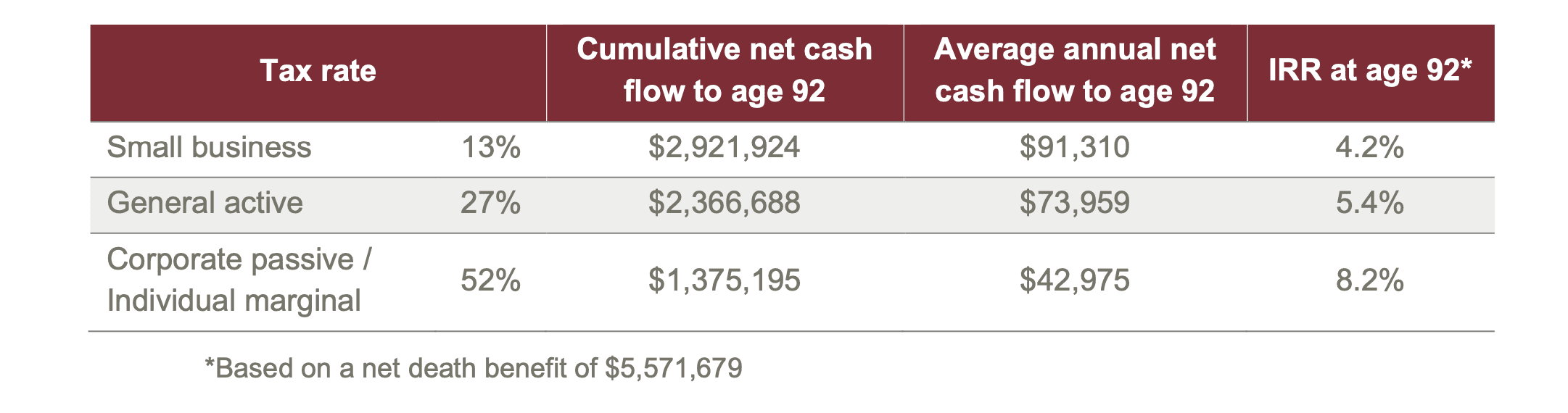

In this case the average annual net cash flow to age 92 is $73,959. As discussed below, if corporate tax was higher, this amount would be lower because of the increased tax savings from the two tax deductions.

Net cash flow and tax rates

The IFA strategy minimizes the impact of insurance costs on your business’ cash flow (or your personal cash flow) in the early years. It also has the potential to minimize the overall funding requirements for insurance coverage until life expectancy. This potential advantage depends a lot on which rate(s) your corporation’s income is subject to tax, or in the case of personal IFA, your marginal tax rate. The higher the tax rate, the higher the savings from the interest and collateral life insurance deductions. Using the example of Chris and Meghan, the table below compares the impact of tax rates in the IFA strategy to the following metrics: cumulative cash flow, average cash flow and internal rate of return (IRR).

Conclusion

The IFA strategy is a method that you, as an affluent business owner or investor, may use to fund your permanent insurance protection. It’s a strategy you can use to acquire insurance without disrupting the cash flow needed to continue growing your business or investment portfolio. It is a complex strategy and should be implemented in conjunction with your tax professional, advisor and their Wealth and Tax Planning consultant resource from a regional Product Solutions Centre.